What ChatGPT Health Reveals About the Future of Banking and Fintech

This week, I signed up for ChatGPT Health. Within minutes, the platform prompted me to connect my medical providers and Apple Health data, pulling multiple sources into a single conversational interface. The result was not just better answers, but a unified, contextual view of my health profile.

What stood out was not the healthcare use case itself, but the architecture behind it.

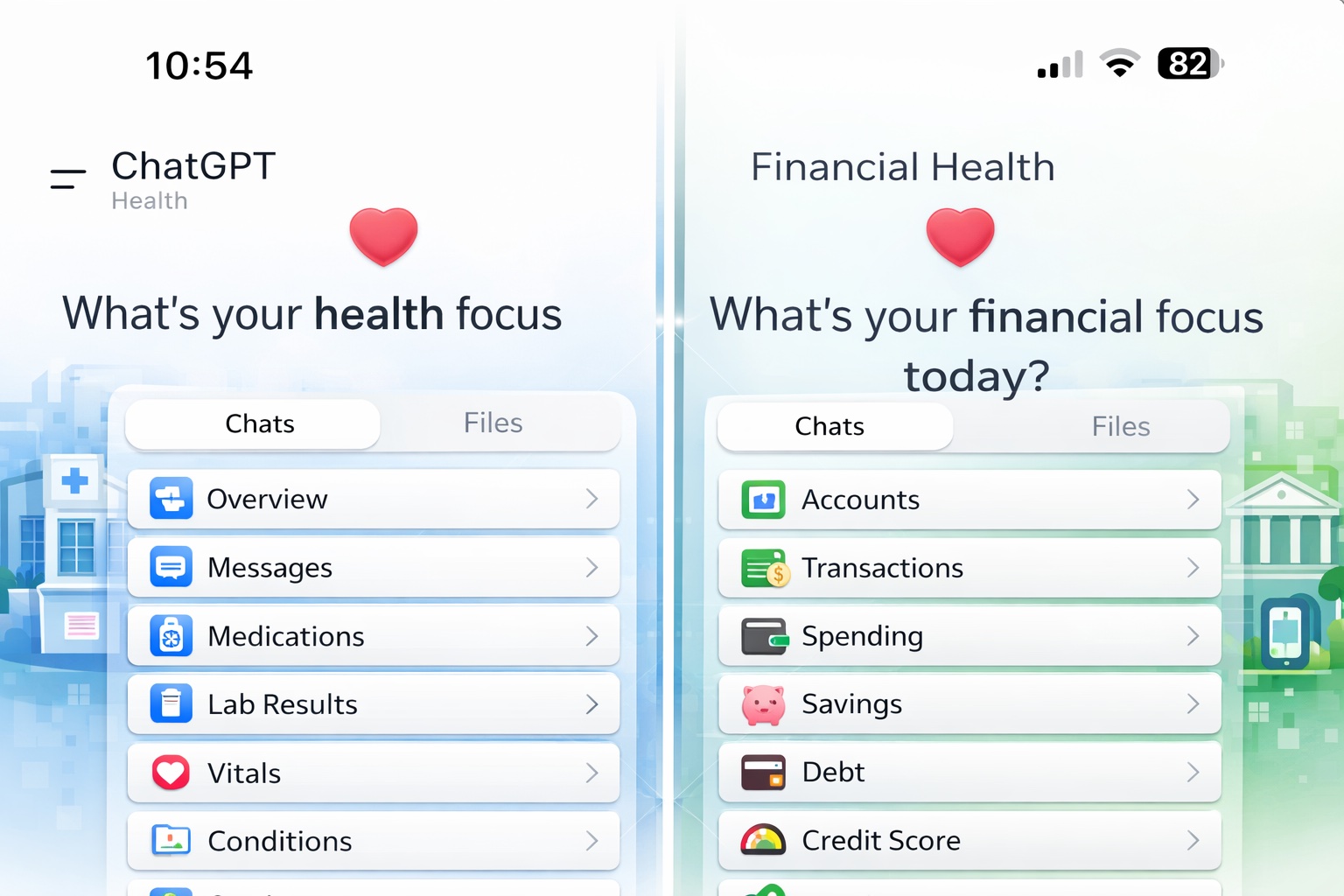

ChatGPT Health functions as a front-end intelligence layer, sitting above multiple systems of record. Instead of logging into separate portals, the user interacts with one interface that understands context, history, and intent. The underlying data remains distributed, but the experience feels centralized.

That model is highly transferable to financial services.

It is easy to imagine the same experience in banking. A member logs into an AI platform, connects their credit union account, potentially through an aggregation layer or core provider API, and that connection becomes the primary conversational gateway to their finances. As with Apple Health, non-credit-union data could be incorporated as well: external accounts, loans, subscriptions, or employer benefits.

The result is a single, continuously updated financial profile, accessible through natural language rather than dashboards and menus.

For fintech providers, this direction is attractive. Many already rely on APIs, aggregation, and normalized data models. Being AI-ready becomes a distribution advantage, not just a technical capability. For credit unions, however, the implications are more complex.

If the primary member interface shifts from a branded digital banking app to an AI platform, the value of owning the front door changes. What matters instead is whether the credit union’s data, products, and permissions integrate cleanly, securely, and in a way that preserves trust.

This does not mean credit unions disappear from the experience. It means their role evolves. Institutions that provide reliable data access, strong identity controls, clear consent management, and disciplined governance will remain central, even if the interaction layer changes.

ChatGPT Health is not just a healthcare story. It is a preview of how AI platforms may become the default interface for complex, multi-source data domains. Banking and fintech share the same structural characteristics. The question is not whether this model appears in financial services, but how quickly institutions prepare for it.

What this means for credit union leaders

For executives and boards, the lesson from ChatGPT Health is not about adopting a new tool. It is about preparing for a shift in how members access and interpret their financial lives.

Key questions to consider:

- If AI platforms become a primary interface, how easily can our data and products integrate?

- Who governs member consent, data sharing, and AI-driven insights?

- Are our vendors preparing for this shift, or reacting to it?

- How do we preserve trust and differentiation when the interface may no longer be ours?

Credit unions that address these questions early will be better positioned than those waiting for the model to arrive fully formed.