Stay ahead of regulatory shifts, vendor updates, and member-facing AI launches. Curated for leaders who need signal, not noise.

Analysis

AnalysisGovernanceOperationsStrategyJanuary 2026

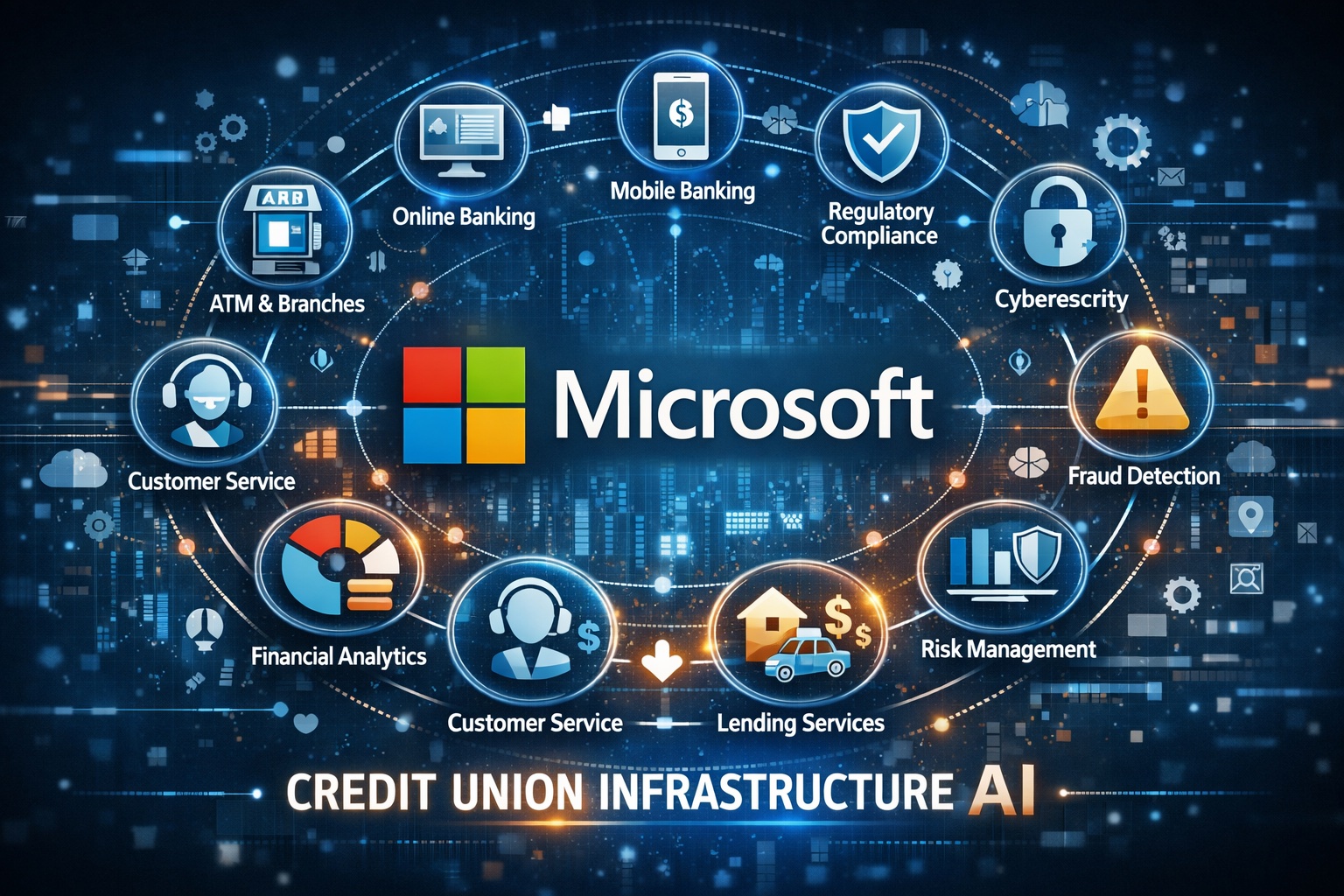

Why Microsoft’s Optimind Launch Signals the Next Phase of AI Adoption for Credit Unions

The shift from AI experiments to governed, operational AI is now unavoidable.

Read more →

Analysis

AnalysisMessagingMember ExperienceEngagementJanuary 2026

How AI Is Reshaping Credit Union Member Messaging Without Losing Trust

AI-assisted messaging is proving to be one of the most practical, trust-preserving entry points for credit union AI adoption.

Read more →

Analysis

AnalysisAI PlatformsData AggregationMember ExperienceStrategyJanuary 2026

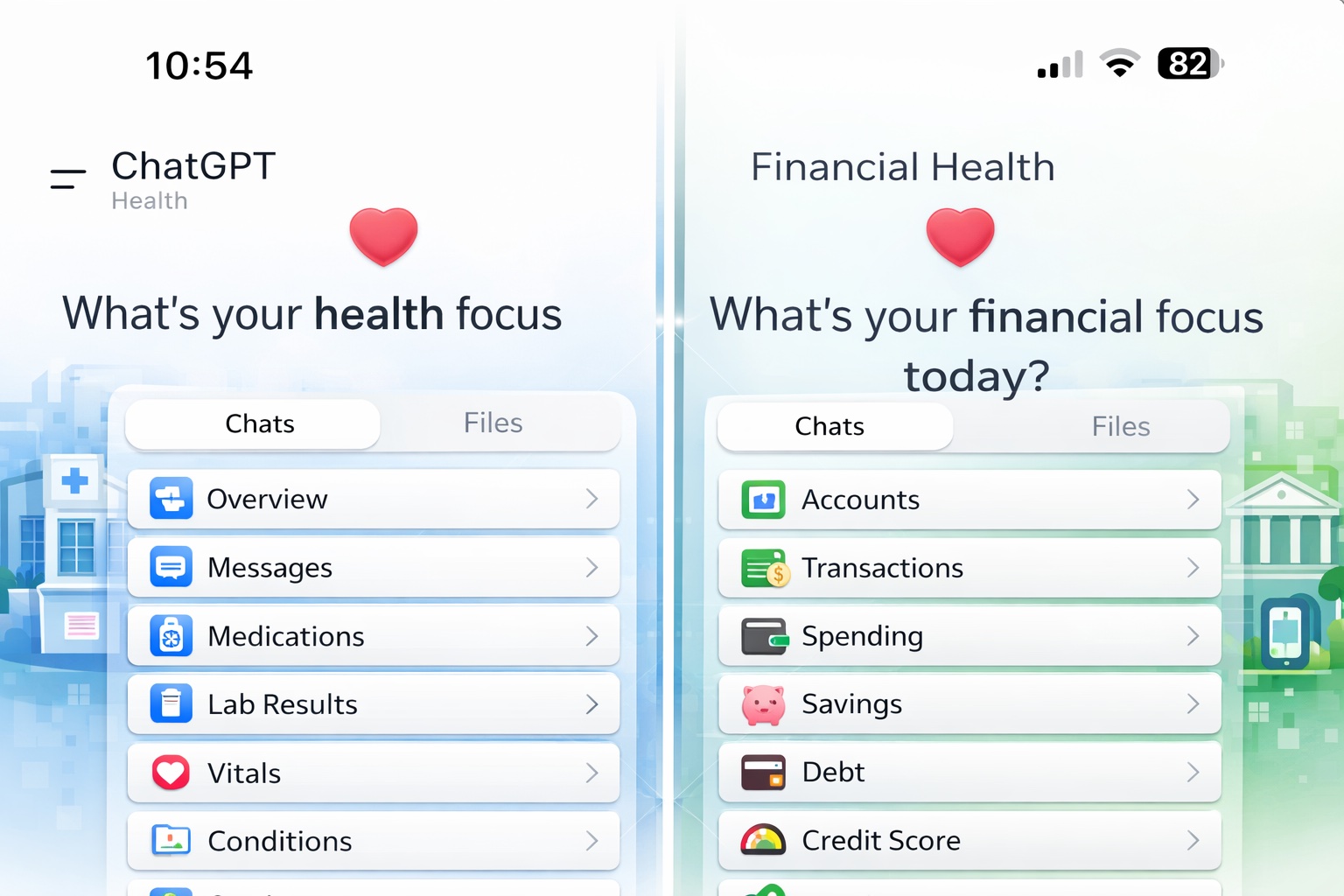

ChatGPT Health Signals How AI Will Become the Front Door for Banking

ChatGPT Health offers a preview of how AI platforms may become the primary interface for banking and fintech.

Read more →

Reporting

ReportingPaymentsAuthenticationFraudGovernanceJanuary 2026

CES 2026 Signals a Shift Toward AI as Financial Infrastructure, Not Experimentation

Fintech and payments vendors emphasized AI as embedded infrastructure for authentication, fraud prevention, compliance workflows, and transaction decisioning.

Read more →

Analysis

AnalysisGovernanceFraudOperationsStrategyJanuary 2026

AI Benchmarks for Credit Unions: What “Good” Looks Like Going Into 2026

Practical benchmarks for AI governance, fraud defenses, employee enablement, and operational wins heading into 2026.

Read more →

Analysis

AnalysisProductivityOperationsSafetyJanuary 2026

ChatGPT 5.2: Practical Ways Credit Union Employees Can Use It at Work (Without Creating Risk)

What actually changed in GPT-5.2 and how frontline, operations, lending, and compliance teams can benefit today

Read more →

Reporting

ReportingAgentic AIAutomationOperationsGovernanceDecember 2025

Posh introduces “AI Operating Procedures” to bring agentic reasoning into regulated banking workflows

Posh outlined structured AI Operating Procedures that aim to pair agentic automation with the controls required in regulated banking.

Posh says its AI Operating Procedures are designed to let AI systems act with clearer guardrails, focusing on predictable behavior, policy alignment, and auditability for regulated institutions.

Read more →

Reporting

ReportingFraudLendingVerificationInvestmentsDecember 2025

Investment firm takes controlling stake in Informed.IQ as lenders confront more sophisticated loan fraud

Invictus Growth Partners’ controlling investment in Informed.IQ highlights lender demand for AI fraud and verification controls.

The investment underscores how lenders are turning to AI-driven document verification and anomaly detection to counter rising loan fraud while managing member experience.

Read more →

Reporting

ReportingCustomer ServiceAIOperationsReutersDecember 2025

Klarna and others pull back from AI hype as customer service finds its limits

Reuters reports firms recalibrating customer service AI expectations, noting complex issues still require human agents.

Companies highlighted in the report are emphasizing escalation paths and monitoring to keep AI helpful without increasing member friction.

Read more →

Reporting

ReportingFraudLendingCredit UnionAIDecember 2025

Velocity Community Credit Union adopts Point Predictive to target identity theft and synthetic identity fraud

Velocity Community Credit Union selected Point Predictive’s AutoPass to strengthen detection of identity theft and synthetic identity risks.

The deployment focuses on catching fraud earlier in lending workflows while balancing loss reduction with member experience.

Read more →

Analysis

NCUARegulationGovernanceAI RiskNovember 2025

NCUA Highlights AI Opportunities and Risks in Updated Resource Center

The NCUA expanded its artificial intelligence resources, urging credit unions to focus on explainability, vendor oversight, and data governance.

The National Credit Union Administration (NCUA) updated its AI Resources Center, outlining what it considers the most important focus areas for credit unions adopting artificial intelligence. Guidance emphasizes explainability, model monitoring, data quality, and vendor oversight — not building models internally.

The regulator stresses that most credit unions will rely on third-party solutions, and therefore should understand how those tools make decisions, how they handle member data, and how results are monitored for fairness.

While not formal regulation, the content signals the agency’s intent to ensure AI is implemented responsibly across the industry. The NCUA encourages boards and leadership teams to stay informed and develop lightweight governance frameworks.

Read more →

Analysis

FraudSecurityMachine LearningPaymentsNovember 2025

Credit Unions Increasingly Turn to AI-Powered Fraud Tools as Attacks Grow More Sophisticated

Industry analysts report rising adoption of machine-learning fraud platforms across credit unions.

AI-powered fraud prevention tools are gaining momentum among credit unions as card-not-present attacks and account-takeover attempts grow more sophisticated. Vendors now offer behavior-based scoring, anomaly detection, and real-time decisioning — capabilities previously accessible only to large banks.

Credit unions are adopting these tools to reduce manual reviews, catch high-velocity fraud patterns, and minimize false declines. Analysts say the shift reflects a broader financial-services trend: fraudsters increasingly use automation and AI themselves, forcing institutions to update their defenses.

Early adopters report improvements in accuracy and fewer member complaints about blocked transactions, though results vary by vendor and implementation.

Read more →

Analysis

Member ExperienceDigital BankingChatbotsOperationsNovember 2025

AI Chat and Virtual Assistants Gain Traction in Credit Union Digital Strategies

More credit unions are deploying conversational AI to reduce call-center volume and improve member self-service.

Conversational AI tools — including virtual assistants, intelligent chat, and guided workflows — are becoming core components of digital-transformation roadmaps at many credit unions. These tools help members complete tasks like card replacement, account inquiries, loan payment questions, and branch information without waiting on hold.

Industry research shows that younger members increasingly prefer chat-based interactions for simple requests, and credit unions are responding by integrating AI into both digital banking and website channels.

While the technology is not perfect, leaders report that virtual assistants reduce friction and free up contact center teams to focus on complex issues that require human attention.

Read more →

Analysis

LendingUnderwritingAutomationRisk ModelsNovember 2025

Lenders Explore AI-Enhanced Underwriting to Speed Up Decisioning

Credit unions are testing machine-learning-based underwriting tools to accelerate application processing.

Credit unions are exploring AI-enhanced underwriting solutions designed to support — not replace — existing decision frameworks. These tools use machine-learning signals to help lenders complete income verification, detect anomalies, and segment applicants more precisely.

The goal is faster, more consistent decisioning while maintaining fairness and risk controls. Experts emphasize that human oversight remains critical, and AI should supplement traditional underwriting rather than fully automate it.

Adoption is expected to grow as credit unions look for ways to improve turnaround times, especially in competitive loan markets.

Read more →

Analysis

FintechDigital ExpectationsPersonalizationUXNovember 2025

Fintechs Push Member Expectations Higher as They Integrate More AI Features

Emerging fintech apps are setting new standards for personalization and speed — indirectly pressuring credit unions.

Fintech companies continue to integrate AI-driven features into their mobile apps, including predictive financial insights, automated savings recommendations, and real-time alerts. These enhancements are reshaping member expectations around convenience and personalization.

Even if members don’t switch providers, they benchmark their credit union experience against the technology they use daily — often expecting the same level of intelligence and speed.

Experts say this trend underscores the importance of investing in member-experience improvements, even at smaller institutions.

Read more →

Analysis

AutomationBack OfficeWorkflowLendingNovember 2025

AI Document Automation Helps Credit Unions Reduce Back-Office Bottlenecks

Document-processing tools powered by AI are making loan and membership workflows more efficient.

AI document-automation systems are helping credit unions reduce manual work associated with income verification, ID checks, loan documentation, and quality review. These tools extract key fields, identify missing information, and flag inconsistencies — allowing staff to focus on exceptions instead of scanning PDFs.

The technology is becoming more accessible, with many providers offering pre-built integrations for mortgage, auto, and consumer lending workflows.

Operational leaders say the biggest impact is reduced turnaround time and fewer repetitive administrative tasks for staff.

Read more →

Analysis

Core BankingVendorsProduct UpdatesAutomationNovember 2025

Core Banking Providers Expand AI Add-Ons for Credit Unions

Major core providers are rolling out new AI-driven features for fraud, analytics, and operations.

Several core banking vendors serving credit unions have introduced AI-powered modules to help institutions modernize without large in-house data science teams.

These add-ons include behavioral fraud scoring, predictive analytics dashboards, segmentation tools, and intelligent routing for digital requests. The goal is to help credit unions adopt AI through familiar systems and existing vendor relationships rather than large custom projects.

Industry analysts say this trend will accelerate as more CUs demand built-in automation and intelligence within their core platform.

Read more →

Analysis

GovernanceBoardsRiskStrategyNovember 2025

More Credit Unions Explore AI Governance as Board Expectations Rise

Boards are increasingly asking leadership teams how AI is being used — and controlled.

Credit union boards are beginning to request clearer explanations of where AI is deployed across the institution, how models are evaluated, and how member data is being used. This is prompting many CUs to develop simple AI governance frameworks and prepare internal “model inventories.”

The goal isn’t full regulatory compliance — it’s clarity. Boards want confidence that leadership understands the technology and its risks.

Consultants say this trend mirrors what happened with cybersecurity several years ago: oversight is becoming a standard expectation.

Read more →

Analysis

Digital BankingPersonalizationEngagementNovember 2025

Digital Banking Platforms Add AI-Driven Personalization Tools for Credit Unions

Several digital banking providers are introducing AI modules that suggest next best actions for members.

Digital banking vendors are adding AI-driven tools that surface personalized recommendations to members based on spending patterns, account status, and financial behavior. These insights appear inside mobile and online banking interfaces, nudging members toward savings, credit-building, or product adoption.

Credit unions adopting these modules report improved engagement, though results depend on data quality and member segmentation strategies.

Industry experts say personalization will soon be a key differentiator, even for smaller CUs.

Read more →

Analysis

Contact CenterProductivityMember ExperienceToolsNovember 2025

AI Contact Summaries Reduce After-Call Work at Many CUs

Automated call summaries are helping agents reduce manual note-taking and speed up queue times.

AI-generated call summaries — now available through several contact-center platforms — are reducing after-call work for credit union agents. Instead of typing long narratives, staff receive an auto-generated summary of each interaction, including intent, resolution steps, and follow-ups.

This shift helps contact centers improve consistency and reduce errors in documentation, while freeing agents to move to the next call sooner.

Leaders say the technology has potential to raise both member satisfaction and employee morale, especially in high-volume operations.

Read more →

Reporting

ReportingNCUARegulationAI GovernanceComplianceNovember 2025

NCUA Launches New AI Resource Center to Guide Credit Unions on Responsible Adoption

The NCUA released a new online hub providing guidance, education, and best-practice considerations for credit unions evaluating artificial intelligence solutions.

The National Credit Union Administration has launched an Artificial Intelligence (AI) Resource Center, giving credit unions a centralized place to learn about regulatory expectations, model governance, vendor oversight, and emerging risks associated with AI adoption.

In its announcement, the NCUA said the resource center is designed to help credit unions “adopt AI in a safe, fair, and responsible manner.” The agency emphasized that most credit unions will not build AI models internally but will instead rely on vendors — making oversight and explainability essential.

“While AI can deliver benefits to both institutions and consumers, credit unions need to ensure these tools are used responsibly and align with consumer protection laws,” said NCUA Chairman Todd Harper.

Industry experts say this move signals that regulators are preparing for broader AI adoption across credit unions while maintaining consumer protection standards.

Citation →

Read more →

Reporting

ReportingFedNowInstant PaymentsPayments InfrastructureNovember 2025

FedNow Adoption Grows as More Credit Unions Enable Instant Payments

The Federal Reserve reports steady increases in financial institutions joining the FedNow network, including credit unions implementing instant-payment capabilities.

The Federal Reserve shared updated data showing continued growth in the adoption of FedNow, its instant payment infrastructure launched in 2023. Dozens of credit unions have joined the network in the past year, reflecting rising member demand for instant transfers and real-time balances.

A Federal Reserve spokesperson noted that participation continues to increase across institutions of all sizes. Credit unions adopting FedNow typically start with member-to-member transfers and internal transfers, with plans to roll out business payments later.

FedNow is expected to influence digital-banking UX expectations, making real-time movement of money feel like a standard rather than a premium service.

Citation →

Read more →

Reporting

ReportingVisaMastercardFraud PreventionCard NetworksNovember 2025

Visa and Mastercard Expand AI-Driven Fraud Detection Capabilities

Both major card networks announced upgrades to their machine-learning fraud systems, impacting issuers including credit unions.

Visa and Mastercard announced enhancements to their AI-powered fraud detection platforms, adding enriched merchant profiling, anomaly detection improvements, and faster issuer alerts.

Visa said its upgraded system analyzes billions of transactions daily and now includes deeper behavioral modeling to spot suspicious patterns earlier. Mastercard emphasized improved accuracy for cross-border transactions and high-risk categories.

These changes will influence how credit unions experience fraud alerts, dispute workflows, and cardholder notifications. Vendors serving CUs are already updating integration modules to support the new network features.

Citation →

Citation →

Read more →

Reporting

ReportingJack HenryDigital BankingCore ProvidersAutomationNovember 2025

Jack Henry Introduces New AI Features for Digital Banking Clients

Jack Henry announced expanded AI capabilities within its Banno Digital Platform, including automated insights and operational efficiencies for community institutions.

Jack Henry released updates to its Banno Digital Platform that incorporate additional AI-driven insights for financial institutions. The new tools support automated member messaging, anomaly detection, and workflow triggers intended to reduce back-office workloads.

The company emphasized that community banks and credit unions can adopt these features without building their own models, relying instead on pre-configured intelligence embedded within Banno.

Industry analysts say these enhancements reflect a broader trend among core providers delivering AI as an integrated service rather than a standalone add-on.

Citation →

Read more →

Reporting

ReportingFISFraudPaymentsMachine LearningNovember 2025

FIS Expands AI-Powered Fraud Tools Across Its Payments Platforms

FIS announced new AI enhancements for its fraud-prevention suite, aimed at improving detection accuracy for issuers, acquirers, and financial institutions.

FIS unveiled a set of AI and machine-learning expansions within its fraud solutions portfolio, including behavioral analytics and enhanced anomaly scoring. The company noted that these capabilities are now accessible to institutions using its payments processing services — including numerous credit unions across the U.S.

FIS stated that the upgrades are designed to help reduce false positives while catching more high-risk transactions. The company highlighted efficiency gains in early pilots with mid-sized institutions.

These updates position FIS alongside other major vendors pushing AI deeper into payments infrastructure.

Citation →

Read more →

Reporting

ReportingNCRATMsBranch OptimizationForecastingNovember 2025

NCR Voyix Announces New AI Tools for Branch and ATM Optimization

NCR Voyix introduced AI-powered capabilities aimed at improving branch operations, cash forecasting, and ATM uptime.

NCR Voyix announced new AI-driven features designed to support branch optimization and ATM fleet management. The company says the tools improve cash forecasting accuracy, reduce downtime, and streamline maintenance workflows.

For credit unions, these enhancements could reduce operational burden, especially in regions where ATM uptime and cash usage remain critical to member expectations.

NCR Voyix noted that these tools are integrated into existing software, requiring minimal operational disruption for credit unions transitioning to AI-assisted forecasting.

Citation →

Read more →