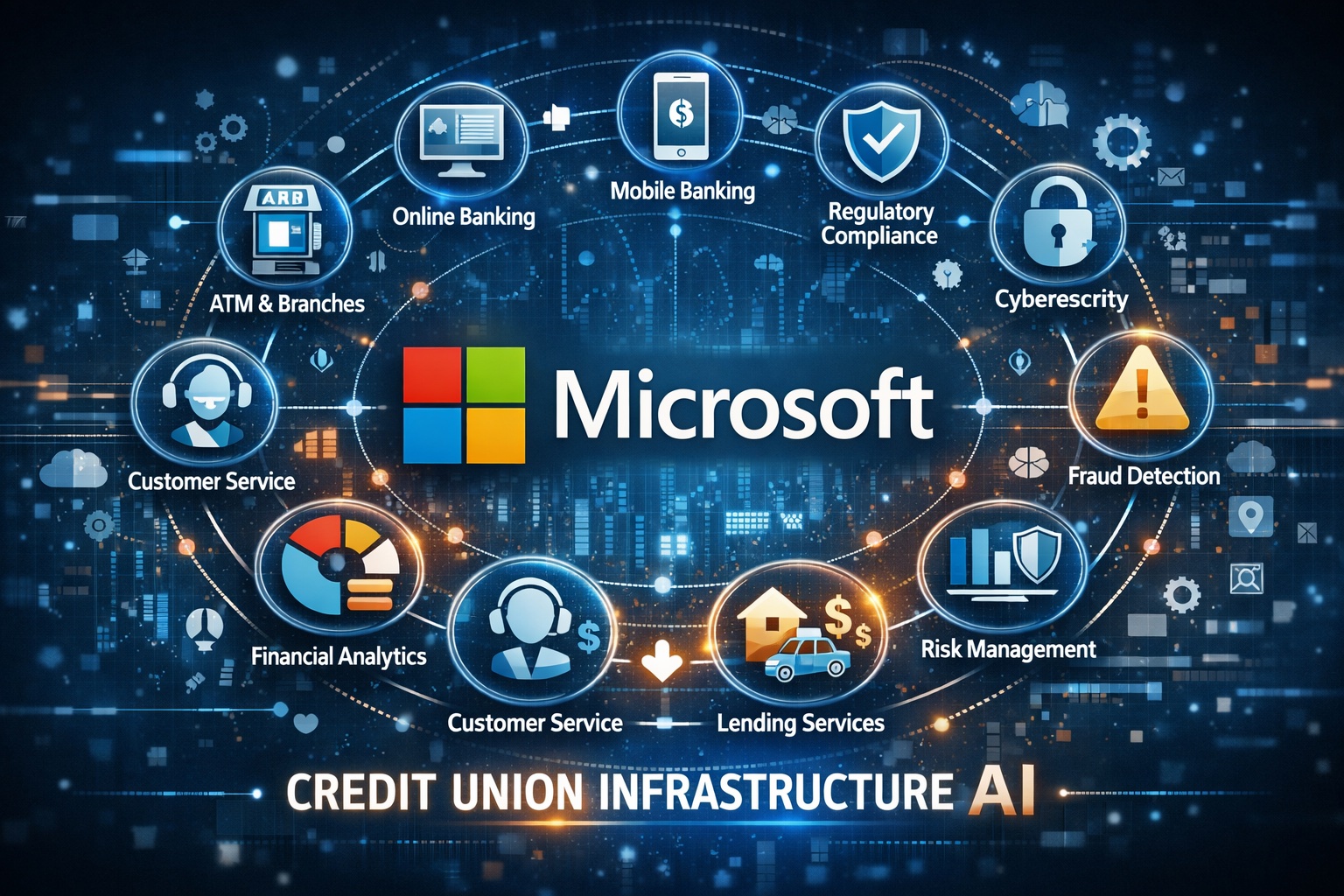

Why Microsoft’s Optimind Launch Signals the Next Phase of AI Adoption for Credit Unions

The shift from AI experiments to governed, operational AI is now unavoidable.

CreditUnionAI News

Coverage of artificial intelligence regulation, fraud, operations, vendors, and strategy for credit unions.

Curated headlines on AI regulation, vendor moves, and frontline member experience.

The shift from AI experiments to governed, operational AI is now unavoidable.

Why AI-assisted messaging is emerging as a practical, trust-preserving entry point for credit unions.

Practical applications across fraud, lending, compliance, marketing, and internal productivity.

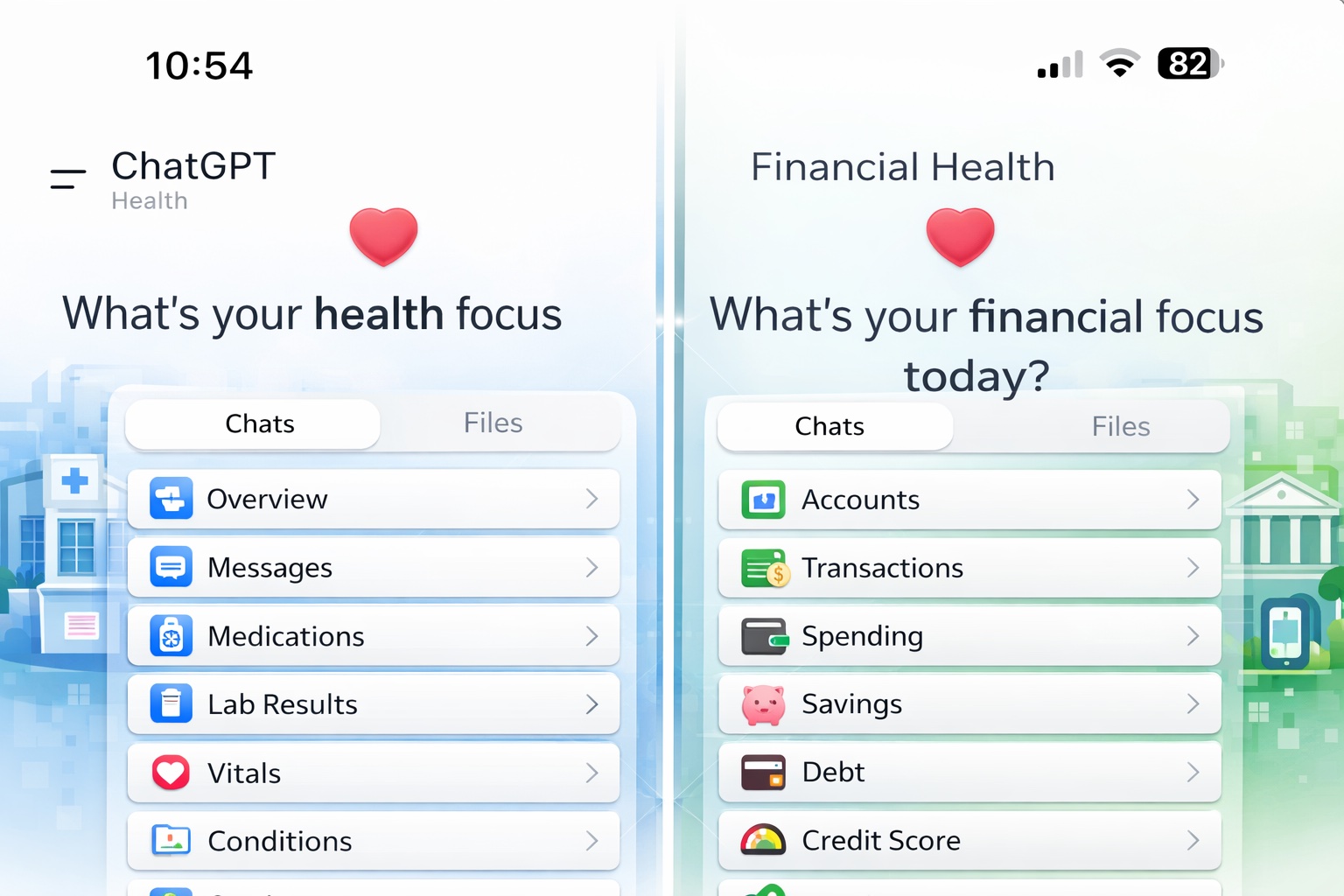

ChatGPT Health previews how AI platforms could become the primary interface for banking and fintech.

Fintech and payments vendors emphasized AI as embedded infrastructure for authentication, fraud prevention, compliance workflows, and transaction decisioning.

Practical benchmarks for AI governance, fraud defenses, employee enablement, and operational gains heading into 2026.

How frontline, operations, lending, and compliance teams can safely benefit from the latest assistant improvements.

Posh framed structured AI Operating Procedures to pair agentic automation with bank-grade controls and auditability.

Invictus Growth Partners’ investment underscores lender demand for AI fraud detection and document verification.

Reuters highlights firms keeping escalation paths in place as AI handles simpler service requests.

A concise audio rundown on AI moves reshaping member service and back office efficiency.

In this SEO-optimized briefing, we explain why artificial intelligence has become essential to credit-union strategy, growth, and member experience. Learn how AI is improving underwriting speed, strengthening fraud detection, enhancing contact-center performance, and streamlining key operational processes across the credit-union industry. This episode breaks down real use cases, early-adopter advantages, and the practical steps credit unions can take to begin implementing AI today. If you’re evaluating AI for lending, payments, risk, compliance, or digital transformation, this concise analysis will help you understand what’s working, what’s changing, and what leaders need to do next. CreditUnionAI News delivers clear, jargon-free insights designed for executives navigating rapid technology change in financial services.